Mutual Funds Are a Rip-Off

This economy has everyone looking to cut costs and tighten their belts. While most people are focused on lowering their spending, huge savings can be found inside your investment account.

BY TIM NASH

June 28, 2022

With $2 trillion invested, Canadians love their mutual funds. They are the default option for most new investors, but I think they’re a rip-off. Do you know how much your mutual funds are costing you? Most Canadians don’t, and the answer is pretty shocking.

How Do Investment Fees Work?

The language around investing has always been pretty confusing, but in this case it’s downright shady. The annual fee for a mutual fund is referred to as the “Management Expense Ratio” or MER for short. The MER is an annual fee that comes straight off the top of your investments. To calculate how much you’re paying, the first step is to look up your mutual fund’s MER.

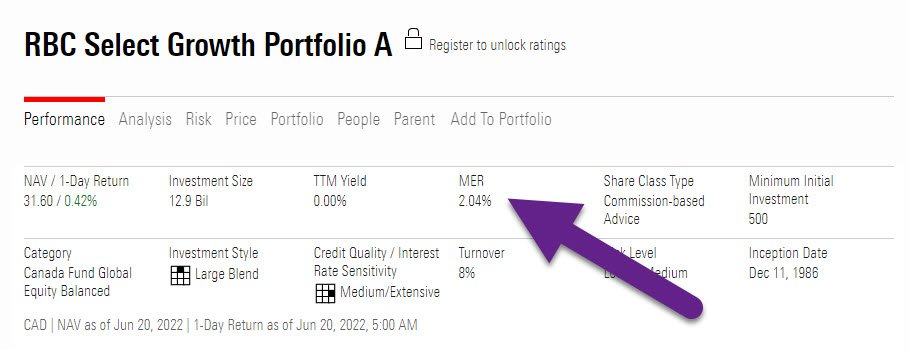

The average mutual fund MER is around 2%. To find out exactly what you’re paying, find the name of your mutual fund on a paper or digital statement. Even better, see if you can find the ‘fund code’ - usually a combination of three letters and three numbers. For example, the RBC Select Growth Portfolio has the code RBF459. You can now look up your mutual fund on Morningstar.ca by putting the name or code into the search bar and clicking on it in the dropdown menu.

Now I can see that the MER of this fund is 2.04%.

How Much Am I Paying?

That 2.04% MER is charged on every dollar you’ve invested in that fund. So, if you have $100k in that RBC mutual fund, you’ll pay $2,040 this year. That works out to $170 every month. For what? Some advisors are very good at client management and will check in with you regularly, but lots of people only ever get paper statements and never hear from their advisor.

What’s the alternative?

Instead of buying mutual funds, we can buy Exchange-Traded Funds or ETFs. Just like mutual funds, ETFs are funds with lots of companies inside. But instead of being sold by salespeople, we buy ETFs directly via the stock exchange. It’s almost like buying a plane ticket online instead of through a travel agent. ETFs are almost identical to mutual funds, but way cheaper. Remember that 2% MER for mutual funds? ETFs are a fraction of the price. For example, the iShares ESG Growth ETF Portfolio – which is similar to the RBC Select Growth Portfolio – has an MER of 0.24%. Instead of paying $170 every month, an investor with $100k would pay just $20 per month. For that investor, switching from mutual funds to ETFs is a simple way to save $150 per month. If you have $200k invested, you’ll save $300 per month in management fees!

Why Are Mutual Funds a Rip-Off?

Since the MER comes straight out of your investments, most people don’t notice what they’re paying. It’s a slow bleed, and you lose the cumulative compounding growth. Over time, this creates a huge drag on your investment growth! In his book Beat the Bank, Larry Bates does a great job explaining this problem. He published an online calculator called the T-Rex Score that shows how much of a drag these fees generate.

Assuming a 6.5% annual return, a 2.04% MER causes an investor to lose more than HALF of their returns over a 30-year horizon. I told you it was shocking!

All else being equal, shifting to low-cost ETFs will dramatically improve your T-Rex Score. Because your monthly savings compound every month, you’ll keep more of the growth and retire with over $240k more money – even if you never add another penny of savings to that original $100k.

Now do you see why I think mutual funds are a rip-off?

Why Do So Many People Still Own Mutual Funds?

Even though it’s one of – if not the – biggest financial decisions we make, most people have their heads in the sand when it comes to their investments. I joke that we spend more time choosing an avocado in the grocery store then we spend choosing a mutual fund for our RRSP. The default setting is that we walk into a bank and speak to a mutual fund dealer. We nod our heads in agreement, and blindly buy whatever they sell us. We don’t know what questions to ask, and we would never now that an innocuous acronym like MER is so gosh darn important.

How Do I Switch from Mutual Funds to ETFs?

I know that taking control of your investments can feel difficult and confusing, but it’s actually pretty easy. We do our best to make it fun switching from Mutual Funds to ETFs! Book a free 30-minute free consultation with Tim to learn more.